Keynote Speaker Announced for the 59th Annual Regional Conference and General Assembly

SCAG is pleased to announce the Keynote Speaker for the 59th Annual Regional Conference and General Assembly, May 2-3 in Palm Desert.

2023 Federal Transportation Improvement Program

Proposed Amendment #23-27

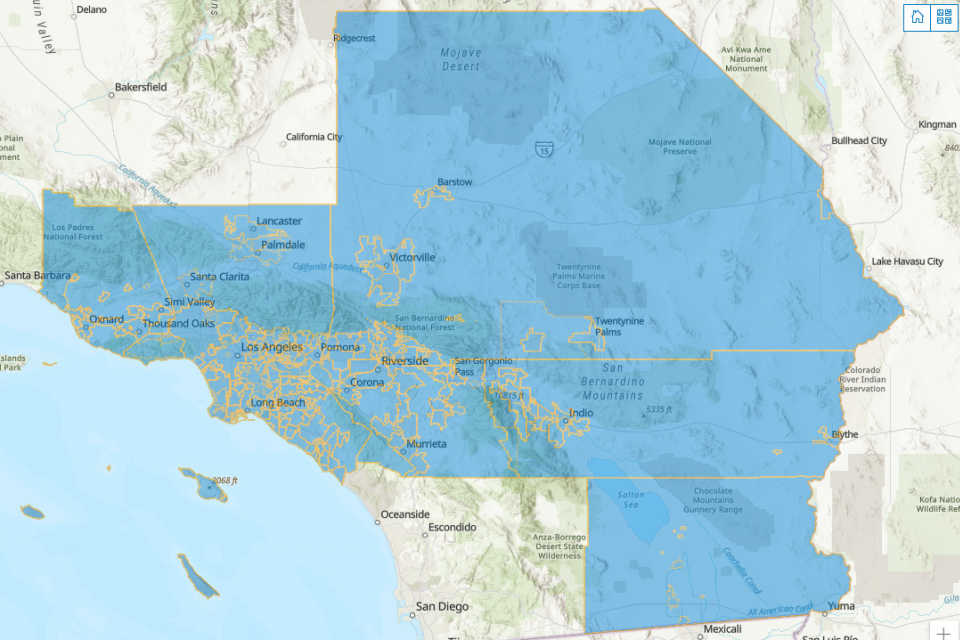

The Southern California Association of Governments is in receipt of the 2023 Federal Transportation Improvement Program (FTIP) Amendment #23-27 for Imperial, Los Angeles, Orange, Riverside, San Bernardino, Ventura and Various Counties. The Public Review period starts on April 9, 2024 and will conclude at 5:00 p.m. on April 18, 2024.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2023-proposed-amendments.

SCAG Regional Council Approves Connect SoCal 2024, Southern California’s Regional Plan

The Southern California Association of Governments (SCAG) Regional Council on Thursday formally adopted the Connect SoCal 2024 Regional Transportation Plan/Sustainable Communities Strategy, a long-term vision to balance future mobility and housing needs with economic and environmental goals over the next 25 years.

Executive Director’s Monthly Report, April 2024

Connect SoCal 2024 Approved

The formal adoption of Connect SoCal 2024 Regional Transportation Plan/Sustainable Communities Strategy (RTP/SCS) by SCAG’s Regional Council marks a significant milestone, putting forward a long-term vision for the future that balances mobility and housing needs with economic, environmental and public health goals over the next 25 years.

Public Release of SCAG’s Connect SoCal 2024 proposed Final Program Environmental Impact Report (SCH# 2022100337)

The Southern California Association of Governments (SCAG), as the lead agency pursuant to California Environmental Quality Act (CEQA), has prepared a 2024 proposed Final Program Environmental Impact Report (PEIR) (State Clearinghouse No.: 2022100337) for the proposed 2024-2050 Regional Transportation Plan and Sustainable Communities Strategy (RTP/SCS), also referred to as “Connect SoCal 2024,”, “2024 RTP/SCS,”, “Plan”, or “Project.” The 2024 PEIR is a programmatic document that presents a region‐wide assessment of potential environmental effects of Connect SoCal 2024.

Introducing SCAG’s Local Investments Dashboard

SCAG recently published a Local Investments Dashboard to gather information about local efforts throughout the region. SCAG’s Local Investments Dashboard shows SCAG-funded efforts in support of shared regional goals included in the Connect SoCal Regional Transportation Plan/Sustainable Communities Strategy. Filter by jurisdiction and type to see various coordinated efforts throughout the region that are meeting both regional goals and community needs.

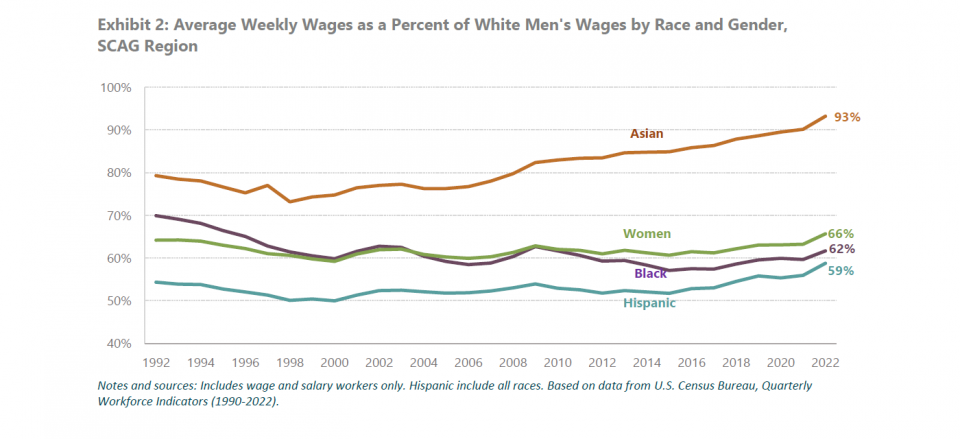

Filling Wage Gaps Would Increase SoCal GDP by 17%

The “Economic Impacts of Equity” report quantifies potential economic benefits from achieving racial and gender equity in wages in Southern California.

Southern California is notably diverse, with communities and individuals originating from all over the world and contributing food, music, events and more to the culture of our cities and neighborhoods—but Southern California has a long way to go in making sure that everyone, and all genders, benefits from its immense economic power.

Executive Director’s Monthly Report, March 2024

Regional Early Action Planning Grant Program of 2021 (REAP 2.0) Advocacy Updates

Governor Gavin Newsom’s proposed budget announced on Jan. 16 includes $300 million in cuts to the Regional Early Action Planning program of 2021 (REAP 2.0) that will result in approximately $123 million in cuts from SCAG’s $246 million REAP 2.0 program.

2023 Federal Transportation Improvement Program

Proposed Amendment #23-23

The Southern California Association of Governments is in receipt of the 2023 Federal Transportation Improvement Program (FTIP) Amendment #23-23 for Los Angeles, Riverside, and San Bernardino Counties. The Public Review period starts on February 2, 2024 and will conclude at 5:00 p.m. on February 12, 2024.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2023-proposed-amendments.

2024 SCAG Scholarship Program Now Open

The annual 2024 SCAG Scholarship Program is now open. To apply for the SCAG Scholarship Program or for more information, visit the SCAG Scholarship website. The program provides a $4,000 scholarship award for seven high school or community college students from the SCAG region. Two additional scholarship awards not tied to a specific county may also be awarded at the Regional Council’s discretion. Recipients may also have an opportunity to meet with their local government representatives and practicing planners to discuss the importance of urban planning and a future career in public service.

Applications are due electronically Friday, March 22. If you have questions about the program, please contact Rachel Wagner at wagner@scag.ca.gov.

Know an eligible student? Please share the 2024 Scholarship Program fact sheet with eligible students.

SCAG Economic Roundtable Update

First Quarter, 2024

SCAG’s Economic Roundtable met for its first 2024 quarterly discussion on the state of the regional economy. The Roundtable discussion focused on the state budget deficit and its potential impacts on the SCAG region, the updated employment situation and tools for building resilience in SCAG’s cities. The following overarching themes emerged from the conversation:

SCAG Now Accepting Applications For The 2024 SCAG Student Showcase

The “Student Showcase” poster and StoryMap competition challenges students to think innovatively and meaningfully to tell a story, provide insight, showcase plans and projects, engage supporters and stakeholders, illustrate the possibilities of data and highlight the usefulness of open data at the regional level. SCAG is proud to invite student participants to conceptualize, create and submit posters and ArcGIS StoryMaps.

SCAG Warns Proposed Budget Cuts Would Have ‘Devastating Impact’ On Cities, Counties In Addressing The Housing Crisis

Kome Ajise, Executive Director of the Southern California Association of Governments (SCAG), released the following statement regarding proposed budget cuts to the Regional Early Action Planning Grants (REAP 2.0) and Infill Infrastructure Grants programs:

SCAG’s 2024 Go Human Community Streets Grant Program: Call for Applications Now Open!

The 2024 Go Human Community Streets Grant Program is open for applications through Feb. 2, 2024. The Community Streets Program provides grant funding to eligible applicants to implement traffic safety strategies through community engagement projects. SCAG will award up to $30,000 to approximately 12 selected traffic safety projects in the SCAG region.

SCAG Awards $35 Million In Infrastructure Funding To Help Local Jurisdictions Meet Housing Goals

On Jan. 4, SCAG’s Regional Council approved $35 million for 12 projects that will help local jurisdictions meet their housing production goals.

Go Human 2023 Year In Review

In 2023, Go Human directed resources to community-led safety and engagement strategies, particularly in communities disproportionately affected by traffic violence and that have been historically excluded from transportation investments. Go Human collaborated with community leaders, nonprofit organizations, cities, and local agencies throughout the region to help build safer and healthier places by:

Joint STBG/CMAQ/CRP Solicitation for Project Nominations

SCAG is now accepting project nominations for Surface Transportation Block Grant (STBG), Congestion Mitigation and Air Quality (CMAQ) and Carbon Reduction Program (CRP) funding. This funding solicitation has an estimated combined budget of $278 million across all three funding sources.

Go Human Community Oral Histories

In response to rising and unacceptable rates of traffic collisions in the region, SCAG’s Go Human campaign promotes the safety of people walking and biking via community engagement, communications, storytelling and direct resource investment. In other words, Go Human actively offers a variety of resources and tools to make communities across Southern California safer for people walking, biking and rolling.

SCAG Year In Review

The Fiscal Year (So Far)

SCAG is proud to collaborate across the region to plan for a brighter future for Southern California. Here are a few highlights from the fiscal year so far!

2023 Federal Transportation Improvement Program

Proposed Amendment #23-20

The Southern California Association of Governments is in receipt of the 2023 Federal Transportation Improvement Program (FTIP) Amendment #23-20 for Imperial, Los Angeles, Orange, Riverside, San Bernardino, and Ventura Counties. The Public Review period starts on December 14, 2023 and will conclude at 5:00 p.m. on December 26, 2023.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2023-proposed-amendments.

SCAG Receives $12 Million in Grants to Develop a Roadway Safety Plan

The Southern California Association of Governments (SCAG) has been awarded $12 million to develop a regional action plan to improve roadway safety, expand its popular Go Human program and help local jurisdictions reduce or eliminate serious injuries and fatalities.

The Planning and Demonstration Grant is one of the largest of its kind being awarded this year by the U.S. Department of Transportation (DOT).

Recap of the 14th Annual Southern California Economic Summit

Nearly 400 attendees joined SCAG for the 14th Annual Southern California Economic Summit on Dec. 7, 2023, to discuss connections between regional planning and the long-term health of the Southern California economy.

SCAG Now Accepting Nominations for the 2024 SCAG Sustainability Awards

SCAG is now accepting applications for the 2024 SCAG Sustainability Awards, SCAG’s annual recognition of plans and development projects that best exemplify the core principles of sustainability. These plans and projects are integral to accomplishing the goals of the , and they promote a cleaner, healthier and happier Southern California.

SoCal To Experience Strong Economic Growth Into 2024

Southern California will ride the wave of strong economic growth entering 2024, buoyed by a healthy labor market, new development, tourism and increased foreign trade, the region’s leading economists said Thursday, Nov. 7.

Economists from across the six-county region offered a mostly optimistic forecast for the coming year, in a report released at the 14th Annual Southern California Economic Summit, though they cautioned that continued inflation and high interest rates will likely slow the rate of growth during the second half of 2024.

SCAG Awarded Certificate of Achievement for Excellence in Financial Reporting

The Government Finance Officers Association of the United States and Canada has awarded the Certificate of Achievement for Excellence in Financial Reporting to SCAG for its annual comprehensive financial report for the 2022 fiscal year.

The Certificate of Achievement is the highest form of recognition in governmental accounting and financial reporting, and its attainment represents a significant accomplishment by a government agency and its management.

SCAG Receives $2.24 Million In Grants For Traffic Safety Programs

The Southern California Association of Governments (SCAG) has been awarded $2.24 million in grants from the California Office of Traffic Safety (OTS) to improve transportation safety, including a new regional safety data analysis and modeling platform, as well as continued work on its regional traffic safety and community engagement program, Go Human.

SCAG Releases Connect SoCal 2024 Draft Program Environmental Impact Report

The Southern California Association of Governments (SCAG), as the California Environmental Quality Act (CEQA) Lead Agency, has released a Draft Program Environmental Impact Report (Draft PEIR) (State Clearinghouse No.: 2022100337) for the proposed 2024-2050 Regional Transportation Plan and Sustainable Communities Strategy (RTP/SCS), also referred to as “Connect SoCal 2024”, “2024 RTP/SCS”, “Plan”, or “Project.” The Draft PEIR serves as a programmatic document that presents a region‐wide assessment of the potential environmental effects of Connect SoCal 2024.

SCAG Awards $45 Million To Support Innovative Housing Finance In Southern California

On Nov. 2, SCAG’s Regional Council approved the allocation of $45 million to 14 innovative housing finance projects across Southern California.

Draft Connect SoCal 2024 Notice of Availability & Public Hearings

Draft Connect SoCal 2024–the draft 2024-2050 Regional Transportation Plan/Sustainable Communities Strategy (RTP/SCS) and draft 2023 Federal Transportation Improvement Program (FTIP) Amendment #23-26.

SCAG Releases Draft Connect SoCal 2024

The Southern California Association of Governments (SCAG) on Thursday released its draft Connect SoCal 2024 Regional Transportation Plan/Sustainable Communities Strategy, outlining direction for the region to meet federal transportation air quality standards and state greenhouse gas emission targets through $750 billion in transportation investments and a regional development pattern. Notable in this plan update are new strategies for addressing the housing crisis and homelessness, adapting to climate change and investing in underserved communities.

SCAG Awards More Than $12 Million For Innovative Approaches To Housing And Climate Adaptation

On Oct. 5, SCAG’s Regional Council approved the allocation of $12.3 million to 22 projects across the six-county region that support increased housing production, sustainable land-use strategies and multimodal communities.

SCAG Economic Roundtable Update

Fourth Quarter, 2023

SCAG’s Economic Roundtable met for its quarterly discussion on the current state of the regional economy. The region’s employment situation, the logistics sector, and labor market conditions were the focus, and several overarching themes emerged from the conversation:

34th Annual Demographic Workshop Spotlights Slower Population Growth and High Housing Costs Across The Region

The number of Southern Californians leaving the state leveled off last year, but the region will continue to experience slow population growth due to accelerated aging and immigration declines, according to data released Wednesday at the 34th Annual Demographic Workshop.

Sponsored by the Southern California Association of Governments (SCAG) and the USC Sol Price School of Public Policy, the workshop brought together the region’s leading demographers and population experts, as well as more than 400 attendees from the public and private sectors.

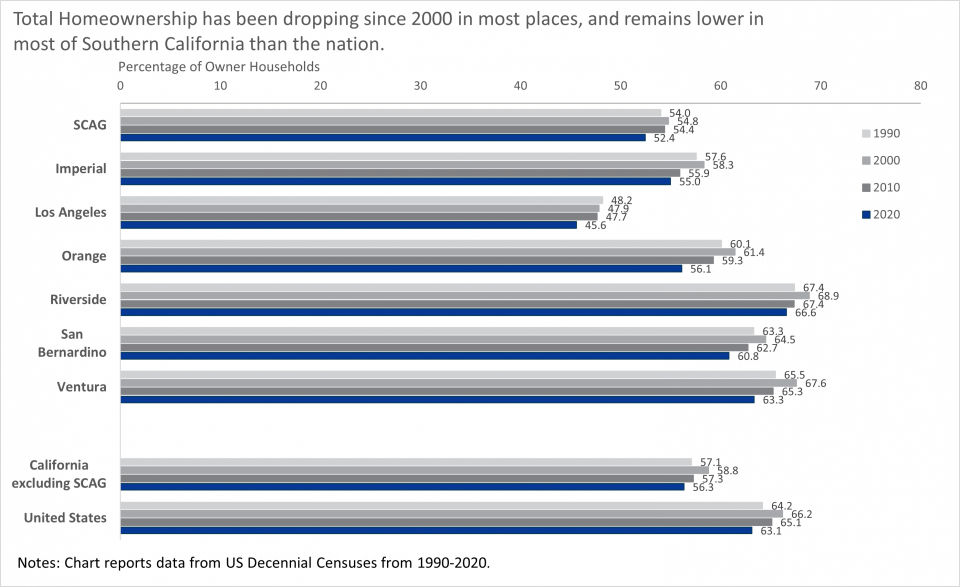

American Community Survey 2022 Data Release

The extent of the changes brought on by the COVID-19 pandemic are still becoming clear. This report examines new data from the American Community Survey to provide insights into how demographic, economic and housing trends in Southern California have changed between 2019 and 2022—and what has stayed the same.

This report compares several topics in demographic, economic and housing conditions across the United States, California, the SCAG region, and each of its six counties. The topics include:

Updates on Connect SoCal 2024 & Stakeholder Engagement

This month, SCAG’s joint policy committee recommended the draft Connect SoCal 2024 Plan to the Regional Council for approval to release for circulation in November. The committee heard a presentation previewing the contents of the Plan, which showcased key policies and strategies to be included in the draft Plan to address existing and emerging challenges facing the region. The presentation also showed how the Plan is based on the best available information, and rooted in local planning and policy actions.

CEHD and Regional Council Approve RHNA Reform Recommendations

In September, the Regional Council approved the release of SCAG’s recommendations on the reformation of the Regional Housing Needs Assessment (RHNA) process. These recommendations will be provided to the California Department of Housing and Community Development (HCD) in a formal letter to be included in a report of recommendations to the California State Legislature.

2023 Federal Transportation Improvement Program

Proposed Amendment #23-14

The Southern California Association of Governments is in receipt of the 2023 Federal Transportation Improvement Program (FTIP) Amendment #23-14 for Imperial, Los Angeles, Orange, Riverside, San Bernardino, and Ventura Counties. The Public Review period starts on August 2, 2023 and will conclude at 5:00 p.m. on August 11, 2023.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2023-proposed-amendments.

SCAG Economic Roundtable Update

Third Quarter, 2023

SCAG’s Economic Roundtable met for its quarterly discussion on the current state of the regional economy last week. Labor market conditions were a major focus of the conversation and several overarching themes emerged:

SCAG Receives $237 Million in REAP 2.0 Funding, Allocates $80 Million to Innovative Transporation Projects

The California Department of Housing and Community Development (HCD) formally awarded SCAG $237 million in REAP 2.0 grants earlier this week to accelerate progress toward state housing goals and climate commitments through a strengthened partnership between the state, its regions and local entities.

2023 Federal Transportation Improvement Program

Proposed Amendment #23-11

The Southern California Association of Governments is in receipt of the 2023 Federal Transportation Improvement Program (FTIP) Amendment #23-11 for Imperial, Los Angeles, Orange, Riverside, Various, and Ventura Counties. The Public Review period starts on June 15, 2023 and will conclude at 5:00 p.m. on June 26, 2023.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2023-proposed-amendments.

New Data Release from 2020 Census

A First Look at the Demographic and Housing Characteristics File in Southern California and Beyond

The United States Census Bureau recently released a critical update to its 2020 numbers, offering additional data on the demographic and housing characteristics of local communities across the country.

This data puts known trends in historical perspective and shows how differently Southern California, and Los Angeles County in particular, has evolved from the rest of the nation in the last generation.

SCAG Go Human Awards $360,000 to 11 Community Driven Projects

SCAG’s Go Human program is thrilled to announce that 11 community organizations have been conditionally awarded funding for local projects that leverage community gathering and resource sites to implement equity-centered, traffic safety and community engagement strategies.

Students Receive 2023 SCAG Scholarships

SCAG has announced 10 students as winners of the 2023 Southern California Association of Governments (SCAG) scholarships.

The SCAG scholarship program, now in its 13th year, is intended to provide financial support to a select group of high school and community college students who have expressed interest in urban planning and public policy as part of their long-term career goals. These outstanding students will receive $4000 each to help bring them closer to achieving their dreams of receiving a college education:

2023 Federal Transportation Improvement Program

Proposed Amendment #23-08

The Southern California Association of Governments is in receipt of the 2023 Federal Transportation Improvement Program (FTIP) Amendment #23-08 for Imperial, Los Angeles, Orange, Riverside, San Bernardino, and Ventura Counties. The Public Review period starts on May 12, 2023 and will conclude at 5:00 p.m. on May 22, 2023.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2023-proposed-amendments.

May is National Bike Month

Celebrate with Go Human this Month and Every Month!

In recognition of Bike Month, Go Human will be sharing bike safety resources with communities across the region. Although Bike Month is nationally recognized in May, Go Human encourages biking and bike safety this month and every month and aims to make biking safer and more enjoyable all year round, through events, infrastructure improvements, safety messaging and materials, and resource distribution. Learn more below!

EVENTS

Find us at the following upcoming events!

SCAG Conference Previews Connect SoCal Regional Transportation Plan/Sustainable Communities Strategy

Nearly 1,000 local and regional leaders are gathering today and tomorrow in Palm Desert for the Southern California Association of Governments’ (SCAG) 2023 Regional Conference & General Assembly, one of the largest events of its kind in the United States. As the nation’s largest metropolitan planning organization, SCAG represents six counties, 191 cities and a population of nearly 19 million.

SCAG Honors Seven Innovative Projects With Its 2023 Sustainability Awards

Seven innovative projects across the six-county region will be honored by the Southern California Association of Governments (SCAG) at the 2023 Sustainability Awards ceremonies at SCAG’s Regional Conference and General Assembly May 4 in Palm Desert. The awards recognize excellence and innovation in planning, land use and transportation to improve mobility, livability, prosperity and sustainability.

15-Day Public Review and Comment Period Open for Draft Connect SoCal 2020 Amendment #3

The Draft Connect SoCal 2020 Amendment #3 and 2023 FTIP Consistency Amendment #23-03 were previously released for a 30-day public review and comment period in Winter 2023.

SCAG Economic Roundtable Update

Second Quarter, 2023

SCAG’s Economic Roundtable met for its quarterly discussion on the current state of the regional economy. The discussion focused on the potential impacts of the Silicon Bank failure on the SCAG region, the logistics sector, water resources, and the regional employment outlook.

Several overarching themes emerged from the conversation:

SCAG Regional Council Approves Digital Action Plan and Active Transportation Program, Adopts Clean Technology Policy

The folllowing is a brief round up of activity from the April 6 SCAG Regional Council meeting.

Digital Action Plan

The Regional Council approved the Digital Action Plan, which outlines SCAG’s actions to provide digital accessibility and foster an equitable, prosperous and resilient region for all residents.

Notice of Comment Period for Conflict of Interest Code Update

NOTICE IS HEREBY GIVEN that the Southern California Association of Governments, pursuant to the authority vested in it by Section 87306 of the Government Code, proposes amendment to its Conflict of Interest Code. A comment period has been established commencing on April 4, 2023 and closing on May 19, 2023. All inquiries should be directed to the contact listed below.

The Southern California Association of Governments proposes to amend its Conflict of Interest Code to include employee positions that involve the making or participation in the making of decisions that may foreseeably have a material effect on any financial interest, as set forth in subdivision (a) of section 87302 of the Government Code. The amendment carries out the purposes of the law and no other alternative would do so and be less burdensome to affected persons.

The proposed changes to the Conflict of Interest Code would add new staff positions, delete old staff positions and revise the titles of existing staff positions to reflect organizational changes since approval of SCAG’s last code amendments by the Fair Political Practices Commission in 2016. The proposed amendment and explanation of the reasons can be obtained from the agency’s contact.

Any interested person may submit written comments relating to the proposed amendment by submitting them no later than May 19, 2023, or at the conclusion of the public hearing, if requested, whichever comes later. At this time, no public hearing is scheduled. A person may request a hearing no later than May 4, 2023.

The Southern California Association of Governments has determined that the proposed amendments:

- Impose no mandate on local agencies or school districts.

- Impose no costs or savings on any state agency.

- Impose no costs on any local agency or school district that are required to be reimbursed under Part 7 (commencing with Section 17500) of Division 4 of Title 2 of the Government Code.

- Will not result in any nondiscretionary costs or savings to local agencies.

- Will not result in any costs or savings in federal funding to the state.

- Will not have any potential cost impact on private persons, businesses or small businesses.

All inquiries concerning the proposed amendment and any communication required by this notice should be directed to: Michael R.W. Houston, Chief Counsel, at (213) 630-1471 or at houston@scag.ca.gov.

SCAG’s 2023 Go Human Community Hubs Grants Program: Call for Projects Now Open

The call for projects for SCAG’s 2023 Go Human Community Hubs Program is open now through April 21. The program facilitates an equity-centered approach to meeting local and regional safety goals by providing funding opportunities for community organizations to implement traffic safety and community engagement strategies. Interested applicants are invited to review the Program Guidelines.

SCAG Receives Funds From FCC To Help Bridge The Digital Divide

On Friday, March 10 the Federal Communications Commission (FCC) announced $66 million in outreach grants to fund projects to expand participation in the Affordable Connectivity Program (ACP). SCAG will be awarded $500,000 of the ACP Outreach Grant Program funds to utilize in helping bridge the digital divide through implementing innovative strategies to reach historically underserved and unserved communities across jurisdictions.

SCAG Economic Roundtable Update

First Quarter, 2023

Despite showing economic resilience, Southern California is likely to follow the nation into a recession and faces several challenges ahead, including potential new supply chain constraints, labor and equitable growth, according to the latest quarterly update from SCAG’s Economic Roundtable.

SCAG Urges Significant Investment To Support Southern California’s Critical Logistics Industry

The Southern California Association of Governments (SCAG) on Thursday urged significant investment in infrastructure, technology and systems to support the region’s role as a global supply chain hub and an economic engine that directly or indirectly accounts for more than one-third of all jobs in the six counties.

Draft FY 2023-24 Overall Work Program

Public Review and Comment Period

On March 2, 2023, SCAG released its Fiscal Year 2023-24 Draft Overall Work Program.

On March 2, 2023, SCAG released its Fiscal Year 2023-24 Draft Overall Work Program.

Download the FY 2023-24 Draft OWP

THE COMMENT PERIOD IS NOW CLOSED.

2023 Federal Transportation Improvement Program

Proposed Amendment #23-05

The Southern California Association of Governments is in receipt of the 2023 Federal Transportation Improvement Program (FTIP) Amendment #23-05 for Imperial, Los Angeles, Orange, Riverside, San Bernardino, and Ventura Counties. The Public Review period starts on March 1, 2023 and will conclude at 5:00 p.m. on March 10, 2023.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2023-proposed-amendments.

HOW TO IMPLEMENT A TRAFFIC SAFETY DEMONSTRATION IN 5 STEPS

USING THE KIT OF PARTS PLAYBOOK

Curious how communities can temporarily redesign streets and advocate for safety improvements? Go Human’s Activations Playbook simplifies this process in 5 steps, using materials from the Go Human Kit of Parts Lending Library.

More Than $1.3 Billion Awarded To Transit And Rail Projects In Southern California

Governor Gavin Newsom announced Tuesday afternoon awards of more than $1.3 billion in state funding to transit and rail capital projects in Southern California, providing a major boost to regional efforts to significantly improve transportation, and reduce greenhouse gas emissions, congestion and vehicle miles traveled.

2023 Scholarship Applications Now Open

Applications for the 2023 SCAG Scholarship Program are now open. The program offers a $4,000 scholarship award for seven high school seniors or community college students from the SCAG region (and potentially two additional scholarship awards that are not tied to a specific county but may be awarded at the Regional Council’s discretion). Recipients may also have the opportunity to meet with elected officials and practicing planners to learn more about careers in public service.

To apply to the SCAG Scholarship Program, students must submit:

SCAG Study on Curb Space Management

With a rise in vehicle ownership, rideshare companies, deliveries and more, over-congested curb space is becoming more common across the Southern California region. In response, SCAG launched the Curb Space Management Study in June 2022.

Transit Ridership Update

SCAG Publishes Quarterly Ridership Update and Regional Dedicated Transit Lanes Study

The Southern California Association of Governments (SCAG) continues to expand its availability of critical data for our region with the release of its quarterly Transit Ridership Update. The latest report, which was presented to SCAG’s Regional Council today, includes:

Draft Amendment 3 to the Connect SoCal – Regional Transportation Plan/ Sustainable Communities Strategy (2020 RTP/SCS or Connect SoCal 2020) and Draft 2023 Federal Transportation Improvement Program (FTIP) Consistency Amendment #23-03

NOTICE OF AVAILABILITY & PUBLIC HEARINGS

The Draft Amendment 3 to the Connect SoCal 2020 (2020-2045 Regional Transportation Plan/Sustainable Communities Strategy “2020 RTP/SCS” or “Connect SoCal 2020”) and the Draft 2023 Federal Transportation Improvement Program (FTIP) Consistency Amendment #23-03 including the associated transportation conformity analysis are available for public review and comment. Information on how to provide public comment is contained in this notice.

2022 SCAG Year in Review

With 2022 coming to an end, we extend a sincere thank you on behalf of everyone at SCAG. As we continue to work together to achieve our unified goals, the region is looking toward a brighter future because of our collaboration.

SCAG Offices Reopen to the Public in January 2023

In response the COVID-19 public health crisis, SCAG offices have been closed to the public since March 2020 and Regional Council and Policy Committee meetings have been held in a hybrid format.

While Regional Council and Policy Committee meetings will continue to be held in a hybrid format for the near future, in January 2023, SCAG offices will reopen to the public to permit participation in SCAG’s legislative body meetings in person.

American Community Survey (ACS) Data in Southern California

A First Look at 2017-2021

On Dec. 8, the Census Bureau released the latest American Community Survey (ACS) 5-year data (2017-2021). The 5-year ACS represents data collected over a period which includes time on either side of the COVID-19 pandemic.

This offers a unique advantage to study estimates for smaller geographic areas (e.g., cities, counties, and neighborhoods) and population subgroups (e.g., workers). Drawing on the current ACS data and comparing it to data from the previous five-year ACS, SCAG staff have computed several key variables for the local jurisdictions in the SCAG region.

Socal To Receive $345 Million In Active Transportation Funding

On Dec. 7, the California Transportation Commission adopted the Statewide Component of the Active Transportation Program, which will bring nearly $345 million in much-needed funds for 22 projects across the SCAG region. Next year SCAG will work with the commission to program an additional $343 million for the region in the MPO Component of this program.

SCAG-region projects included in the funding approval:

Go Human 2022 Year In Review

In 2022, Go Human provided resources to communities across the SCAG region, prioritizing those that have been disproportionately impacted by traffic violence. Emphasizing community-led storytelling, Go Human funded and amplified local groups and agencies working to improve safety in their neighborhoods. Throughout 2022, the Go Human program engaged more than 800,000 people and 46 jurisdictions in 26 Mini-Grant Projects, 20 Kit of Parts safety demonstrations, and the distribution of more than 11,000 safety messaging materials.

Southern California’s Strengths Could Soften Impact of Recession

At the 13th Annual Southern California Economic Summit, hosted Thursday by the Southern California Association of Governments (SCAG), economists reporting on each of the six SCAG region counties indicated Southern California’s current economic strengths as:

- Continued growth in core industries, such as information, logistics and tourism.

- Measurable increases in labor productivity in 2022.

- New development and construction in infrastructure and housing, both public and private.

- Household debt and real estate values that are less likely to decline than elsewhere.

“Southern California is a major economic driver, not only for the region but the world. As a result, we are in a better position than most to withstand some of the negative economic pressures that are surfacing,” said Wallace Walrod, Chief Economist for the Orange County Business Council.

More than 400 regional leaders participated in this year’s Summit, which took place amid growing uncertainty about the state of the global economy. While the job market has been strong throughout much of the world, inflation concerns have triggered interest rate hikes as governments try to rein in prices.

Building on prior annual summits, SCAG convened a new Economic Roundtable consisting of experts across the region as well as specialists in labor, equity and sustainability to provide both a current snapshot of Southern California, as well as a preview of economic opportunities and challenges ahead. Their research was released in a report that offers caution on turbulence ahead from global forces, but also promise that Southern California is better positioned than other regions to withstand it.

Among factors that could moderate the impacts of a possible recession across the six-county SCAG region:

- Strong outlooks for the three industry sectors currently experiencing the most robust job growth: Information; Transportation and Warehousing; and Arts, Entertainment and Recreation.

- Labor force participation throughout the region has returned to pre-pandemic levels.

- Continued heavy demand for housing, commercial building and infrastructure development, which has led to the highest construction employment levels since the 2008 housing crash.

- Strong demand and spending on non-residential construction, which has increased by 19.3 percent, in real terms, over the past year – a trend expected to persist into 2023.

- Productivity gains in 2022, as the region’s GDP/capita increased 7.6 percent in 2022.

The report also identified localized opportunities across the region. In Imperial County, for instance, billions of dollars of investment in new geothermal and rare-mineral extraction has the potential to create thousands of new jobs and significantly increase the county’s tax base. The Inland Empire’s role as a global supply chain hub should continue to drive job growth, though the area’s long term prospects would benefit from diversification into sectors offering higher quality jobs. And in Orange County, emerging industry clusters, such as medical devices, biotech, information technology and advanced transportation (EVs and hydrogen), along with major new developments, such as Disneyland Forward and OCVibe, promise vibrant future economic growth.

“Improvements in the global inflation picture, combined with continuing 2022’s positive momentum, the region’s economy raises hopes that the much-anticipated global recession of 2023 may not impact Southern California as severely,” said Dr. Gigi Moreno, Senior Economist at SCAG.

Even so, the economists urged policymakers to recognize and be able to adapt to early clues about a broader economic weakening, including:

- Significant downward shifts in the labor market.

- A meaningful slowdown in consumer and business spending in the region.

- A collapse of interest rate-sensitive sectors, such as new and existing housing.

- Rising unemployment leading to increased out-migration from the region or inability to service mortgage payments.

- Other debt that would raise the probability of asset devaluation.

Other threats include high housing costs and a proliferation of lower paying jobs, which have flattened real income growth, could soften consumer spending, and further increase wealth inequity. Another challenge is a decrease in the region’s overall population – down 300,000 people since 2019 – due to out-migration, increased mortality and a steep drop in foreign immigration, which threatens to stymie innovation and job growth.

In Los Angeles County, real gross domestic product growth is expected to slow to 2.9% in 2022 and 1.3% next year.

“LA County’s strong post-COVID recovery is at risk of a slowdown over the next five years,” said Shannon Sedgwick, Director of the Institute for Applied Economics at the Los Angeles County Economic Development Corporation (LAEDC). “The deep socioeconomic inequities spotlighted by the pandemic remain and are now seen with lower income households disproportionately feeling the effects of inflation.”

Ventura County, meanwhile, is among the most vulnerable localities with the SCAG region with regard to a potential recession.

The county has struggled this year to attract the workforce lost during the pandemic recession. Despite a historically low unemployment rate of 3.2 percent, the county has thousands of unfilled positions.

“The local economy in Ventura County is the most sluggish in the SCAG region in terms of job growth, new housing, and consumer spending on retail goods and services,” said Mark Schniepp, Principal of the California Economic Forecast.

Click here for the complete Southern California Economic Update.

SCAG Receives Grant for Go Human Traffic Safety Program

The Southern California Association of Governments (SCAG) has been awarded a $1.18 million grant from the California Office of Traffic Safety (OTS) to fund continued work on its regional traffic safety and community engagement program, Go Human.

SCAG 2022 Racial Equity Baseline Conditions Report Now Available

On Nov. 3, 2022, the Southern California Association of Governments (SCAG) released its 2022 Racial Equity Baseline Conditions Report, which is available as a tool to further understand where the six-county region stands regarding advancing justice, equity, diversity and inclusion in the region.

2021 Federal Transportation Improvement Program

Proposed Amendment #21-32

The Southern California Association of Governments is in receipt of the 2021 Federal Transportation Improvement Program (FTIP) Amendment #21-31 for Orange County. The Public Review period starts on October 28, 2022 and will conclude at 5:00 p.m. on November 7, 2022.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2021-proposed-amendments.

Honoring Walktober & Pedestrian Safety Months

Celebrating the 2022 Go Human Mini-Grant Projects

To recognize California Pedestrian Safety Month (September), National Pedestrian Safety Month (October) and Walktober (October), SCAG celebrates Go Human’s local traffic safety efforts through its 2022 Go Human Mini-Grants Program.

CEQA Notice of Preparation of a Draft Program Environmental Impact Report for SCAG’s Connect SoCal 2024

The Southern California Association of Governments (SCAG), as the CEQA Lead Agency, has released a Notice of Preparation (NOP) of a Draft Program Environmental Impact Report (PEIR) for Connect SoCal 2024 (2024-2050 Regional Transportation Plan/Sustainable Communities Strategy).

2021 Federal Transportation Improvement Program

Proposed Amendment #21-31

The Southern California Association of Governments is in receipt of the 2021 Federal Transportation Improvement Program (FTIP) Amendment #21-31 for Imperial, Orange, and Riverside Counties. The Public Review period starts on October 14, 2022 and will conclude at 5:00 p.m. on October 24, 2022.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2021-proposed-amendments.

SCAG Adopts Resolution on Water Action

On Oct. 6, 2022 the Southern California Association of Governments (SCAG) formally affirmed the drought and water shortage emergency in Southern California and called on local and regional partners to join together to adopt an “all of the above” approach to addressing the region’s water challenges and catalyzing opportunities across a six-county region that’s home to more than 19 million people.

Draft 2023 Federal Statewide Transportation Improvement Program (FSTIP)

The Draft 2023 Federal Statewide Transportation Improvement Program (FSTIP) is now available for public review at the following website:

2023 Federal Transportation Improvement Program

Proposed Amendment #23-01

The Southern California Association of Governments is in receipt of the 2023 Federal Transportation Improvement Program (FTIP) Amendment #23-01 for Imperial, Los Angeles, Orange, Riverside, San Bernardino, Various, and Ventura Counties. The Public Review period starts on October 6, 2022 and will conclude at 5:00 p.m. on October 17, 2022.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2023-proposed-amendments.

SCAG AND PARTNERS RECEIVE AWARDS FROM AMERICAN PLANNING ASSOCIATION (APA) SECTIONS & CHAPTERS

SCAG’s Go Human program is thrilled to highlight four (4) projects that the American Planning Association has awarded at the section and state levels! The following Go Human partner projects have been recognized for positively impacting traffic safety and community engagement across the region.

Work-From-Home Rates Have Tripled Since 2019, Impacting Commutes Across the Region

The number of Southern Californians primarily working from home more than tripled between 2019 and 2021 – a “dramatic and universal” surge that has significantly impacted the commuting landscape across the region since the start of the COVID-19 pandemic, a new analysis of U.S. Census data shows.

2021 Federal Transportation Improvement Program

Proposed Amendment #21-28

The Southern California Association of Governments is in receipt of the 2021 Federal Transportation Improvement Program (FTIP) Amendment #21-28 for Imperial, Los Angeles, Orange, Riverside, and San Bernardino Counties. The Public Review period starts on September 8, 2022 and will conclude at 5:00 p.m. on September 19, 2022.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2021-proposed-amendments.

SCAG Honors the Late Carmen Ramirez for Her Trailblazing Leadership

The Southern California Association of Governments (SCAG) honored the memory of “a trailblazing leader and beloved friend” – the late Ventura County Supervisor Carmen Ramirez – by putting forward a proclamation to posthumously confer the honorary title of Regional Council President, In Memoriam, and rename an annual scholarship after her.

The Southern California Association of Governments (SCAG) honored the memory of “a trailblazing leader and beloved friend” – the late Ventura County Supervisor Carmen Ramirez – by putting forward a proclamation to posthumously confer the honorary title of Regional Council President, In Memoriam, and rename an annual scholarship after her.

Ms. Ramirez, who served as SCAG’s Regional Council First Vice President, was tragically killed on Aug. 12, 2022, in a pedestrian-vehicle accident in Oxnard. She previously served on the Oxnard City Council before being elected to the Board of Supervisors in 2020. She was the first Latina to serve on the Board and was Chair at the time of her death.

SCAG mourns Regional Council First Vice President and trailblazing Ventura County Supervisor Carmen Ramirez

SCAG leadership and staff are shocked and saddened by the sudden loss of Regional Council First Vice President Carmen Ramirez who died Friday evening, August 12, 2022, after being struck by a vehicle in downtown Oxnard.

“The region has lost a tremendous woman and a skillful leader. Our hearts go out to Carmen’s family, as well as the many others who knew and loved her,” said Regional Council President Jan Harnik.

SCAG Honored with the Making a Difference Award from Esri

SCAG is excited to announce it was awarded the Esri 2022 Making a Difference Award during the Esri User Conference on July 11. Presented by Esri President and Founder Jack Dangermond, the award recognizes organizations or individuals who, through the use of GIS, have made a positive impact in their community.

Go Human Mini-Grants Awarded

The Southern California Association of Governments (SCAG) has conditionally awarded more than $350,000 to community and nonprofit organizations to improve pedestrian and bicycle safety in targeted communities across the six-county SCAG region.

The 26 awarded projects will receive funding through the Mini-Grants Program, which is part of Go Human, SCAG’s regional active transportation safety and encouragement campaign. Projects are awarded up to $15,000 to implement safety and engagement strategies between June and August 2022.

SCAG Go Human Awards More Than $350,000 to 26 Community-Driven Projects

Go Human is excited to announce that 26 Mini-Grants have been conditionally awarded to fund creative, community-identified and community-led strategies to improve traffic safety and address mobility justice across the region. Mini-Grant projects aim to improve pedestrian and bicycle safety for those most harmed by traffic injuries and fatalities, including Black, Indigenous, and People of Color; people with disabilities; and frontline workers.

Draft 2023 Federal Transportation Improvement Program (FTIP) and Draft Amendment 2 to the Connect SoCal – Regional Transportation Plan/ Sustainable Communities Strategy (RTP/SCS)

NOTICE OF AVAILABILITY & PUBLIC HEARINGS

The Southern California Association of Governments (SCAG) has prepared the Draft 2023 FTIP in compliance with the adopted 2020 Connect SoCal and all federal and state requirements. SCAG has also prepared the Draft Amendment 2 to the 2020 Connect SoCal to reflect additions and/or changes to several critical transportation projects that are ready to move forward to the implementation phase.

2021 Federal Transportation Improvement Program

Proposed Amendment #21-25

The Southern California Association of Governments is in receipt of the 2021 Federal Transportation Improvement Program (FTIP) Amendment #21-25 for Imperial, Los Angeles, Orange, Riverside, San Bernardino, Various, and Ventura Counties. The Public Review period starts on June 30, 2022 and will conclude at 5:00 p.m. on July 11, 2022.

A copy of the Project Listing is located on the SCAG FTIP website Proposed Amendment link at https://scag.ca.gov/2021-proposed-amendments.

Go Human Partners With The ATRC & CalWalks To Expand The Kit Of Parts Statewide

Apply today!

SCAG Awarded the Major Metro Achievement Award from the NARC

SCAG is excited to announce it was awarded the Major Metro Achievement Award from the National Association of Regional Councils (NARC) for the SCAG Housing Policy Leadership Academy (HPLA) during the 56th Annual NARC Conference and Exhibition on June 14.

Palm Desert’s Jan Harnik Sworn In As SCAG President As Nation’s Largest Metropolitan Planning Organization Faces Critical Year Ahead

Newly installed President Jan Harnik is taking the long view on what the next 12 months will mean for the six-county Southern California Association of Governments (SCAG) region as it confronts critical issues such as broadband access, transportation, air quality and the housing crisis.

Future Of Southern California In The Spotlight As Hundreds Gather In Palm Desert For SCAG’s 2022 Regional Conference & General Assembly

More than 700 local leaders from throughout Southern California will gather in Palm Desert this week for a two-day conference on topics such as bridging the digital divide, the housing crisis and how local governments can work together to address challenges and solutions facing the region. The Southern California Association of Governments’ (SCAG) 2022 Regional Conference & General Assembly returns to the desert after a two-year absence due to the COVID-19 pandemic.

A Conversation on Biking While Black with Yolanda Davis-Overstreet

As SCAG’s Go Human campaign prepares to launch another year of traffic safety strategies, we reflect on the people and projects that we’ve partnered with to make an impact in the Southern California region. At the forefront of this work is a partner and project that works at the intersection of social and environmental justice issues: Yolanda Davis-Overstreet and her short documentary “Biking While Black.”

As SCAG’s Go Human campaign prepares to launch another year of traffic safety strategies, we reflect on the people and projects that we’ve partnered with to make an impact in the Southern California region. At the forefront of this work is a partner and project that works at the intersection of social and environmental justice issues: Yolanda Davis-Overstreet and her short documentary “Biking While Black.”

SCAG Honors 7 Innovative Projects with its 2022 Sustainability Awards

A public-private partnership to advance battery-electric freight movement leads a list of seven innovative projects across the region that have been announced as winners of the 2022 Sustainability Awards by the Southern California Association of Governments (SCAG).

GO HUMAN MINI-GRANTS ARE BACK!

APPLY FOR UP TO $15K BY 4/29/22

The Southern California Association of Governments (SCAG) is now accepting applications for the 2022 Go Human Mini-Grants Program.

An Equity First Approach is a Necessary Foundation for Road Pricing Strategies, Study Shows

Transportation access poses one of the biggest barriers to closing the equity gap, but Southern California has the opportunity to turn this challenge into an opportunity with a thoughtful and inclusive approach to pricing strategies and other mobility innovations, new research shows.